Why Are Supply Chains a C-Level Problem?

Supply chains have become one of the most urgent priorities for global CEOs and C-level executives, and for good reason. Especially those in global manufacturing and retail, supply chains are no longer just a logistical concern to be managed at the operational level—they are now a strategic imperative that directly affects profitability, competitiveness, resilience and long-term sustainability.

A return to equilibrium, a belief that things will stabilize and remain predictable, has been a common theme among C-level discussions post-COVID. This assumption is misleading—especially when it comes to supply chains. Many leaders mistakenly think that after the intense disruptions caused by the pandemic, supply chain challenges are largely behind us.

Complacency kicks in, maybe?

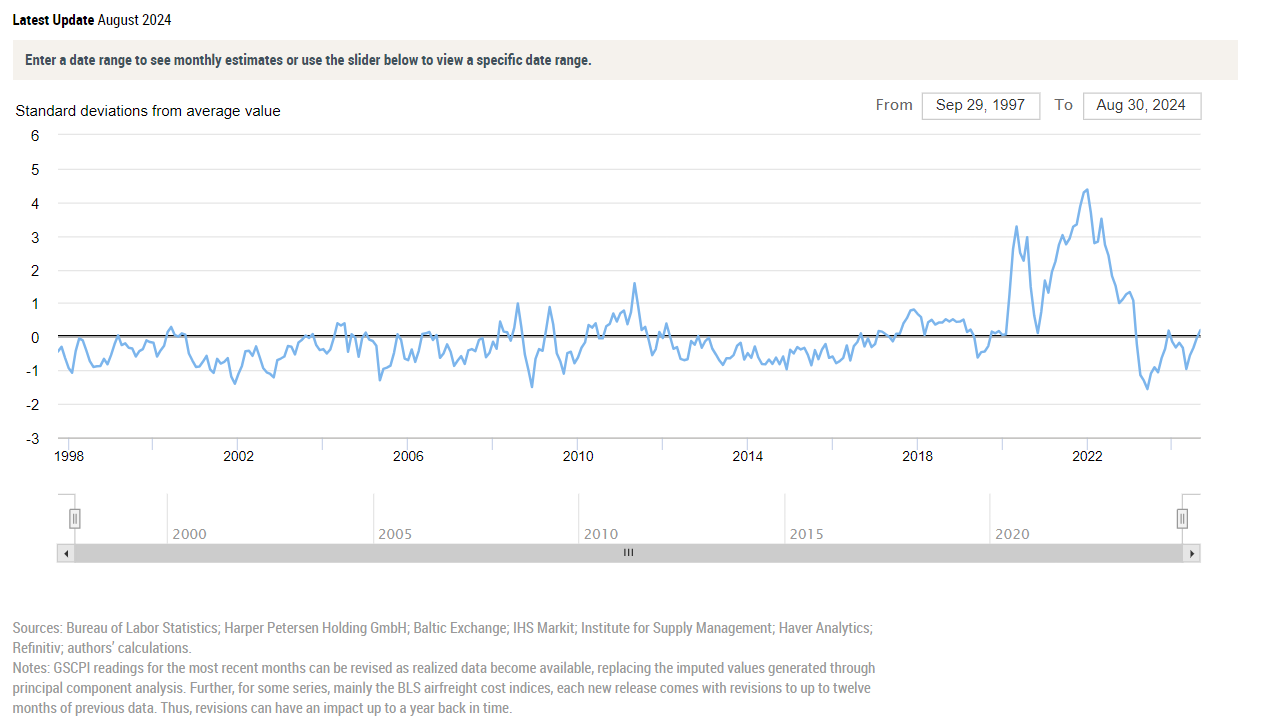

The data might even support this false sense of security: The New York Fed’s index of supply chain pressure, which spiked dramatically during the pandemic, has largely returned to pre-crisis levels.

However, this apparent calm is deceptive. Supply chain risks today are deeper, more systemic, and more strategic than ever before. They threaten not just operational efficiency but the very foundations of how businesses function.

Tobias Meyer, the CEO of DHL, shared his concerns at the latest GEF in Davos over the new normal for supply chains. He added that during 2024 and 2025 the world will continue to see volatility “because the sources of disruption are just very active.”

For CEOs and boards, this means supply chains must sit at the top of the agenda—far beyond the purview of procurement or operations. These risks can no longer be managed solely at the tactical level; they require strategic oversight at the highest levels of the organization.

The main reasons why supply chains became a strategic priority

Three critical trends have emerged, fundamentally altering the stability of global supply chains and making them a top concern for C-levels in all industries, especially in manufacturing.

- Global geopolitical instability

Geopolitical volatility is now the norm. Ongoing conflicts—whether in the Middle East, Eastern Europe, or East Asia—disrupt critical trade routes and inject uncertainty into global markets. Many of these flashpoints are perilously close to vital shipping chokepoints, such as the Suez Canal and the Straits of Hormuz and Taiwan.

For manufacturing leaders, this instability directly threatens their ability to move goods efficiently, increase production, and maintain margins. Disruptions in any of these regions can lead to significant delays, cost increases, or even complete halts in production.

- Deglobalization and increasing trade restrictions

Another major force reshaping supply chains is the shift toward deglobalization. According to the World Bank, the number of trade restrictions has exploded, with nearly 3,000 new restrictions imposed globally in 2023 alone.

For CEOs, this trend means higher costs, decreased market access, and a growing need to rethink global supply chains. Nearshoring and friendshoring are already underway, with companies moving production closer to home or to politically stable regions.

- Sustainability and corporate ethics

Sustainability has become a critical factor in the health of global supply chains. Consumers, investors, regulators, and employees are demanding that companies reduce the environmental and social costs of their supply chains. Failures to comply—whether through environmental degradation or labor violations—can lead to severe reputational damage and operational disruptions. Moreover, regulations are tightening, with governments around the world imposing stricter sustainability requirements.

Executives must now view sustainability not as a corporate social responsibility box to be checked but as an integral part of risk management. Supply chain sustainability is no longer a procurement issue; it requires input and action from the top leadership to ensure that ethical practices are embedded at every level of the supply chain.

How informed are top execs about supply chain performance?

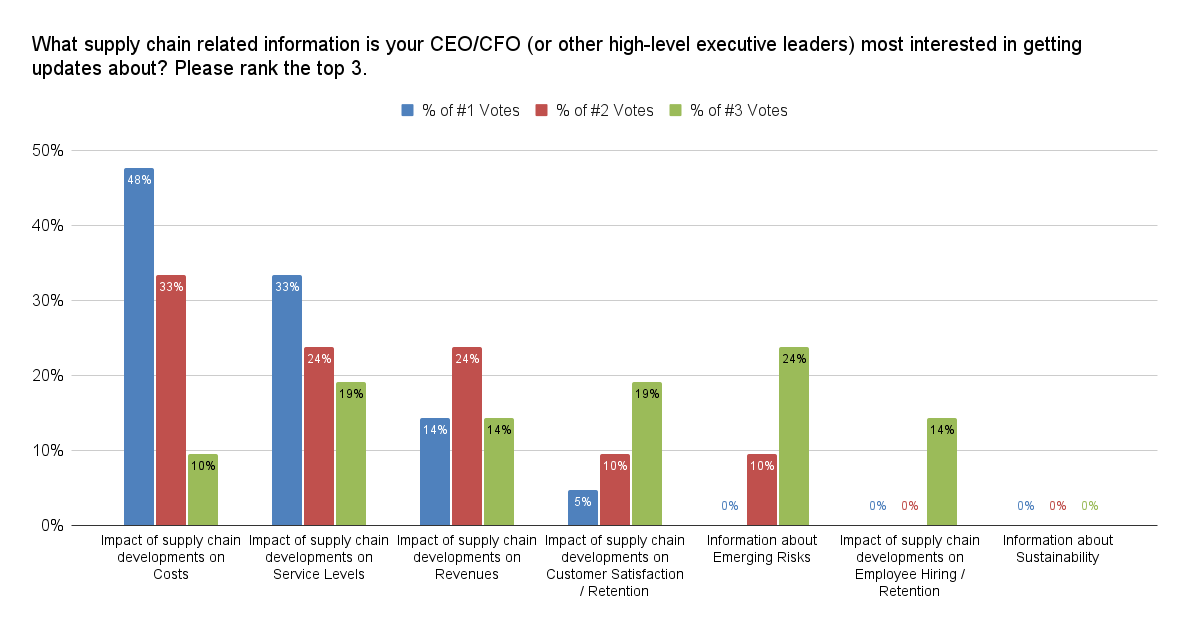

According to the Indago survey, CEOs/CFOs are most interested in getting updates about the impact of supply chain developments on costs. It received the most votes overall and the greatest percentage of #1 votes (48%). Rounding out the top three were the impact on service levels (33%) and revenues (14%).

Supply chain risks and the board

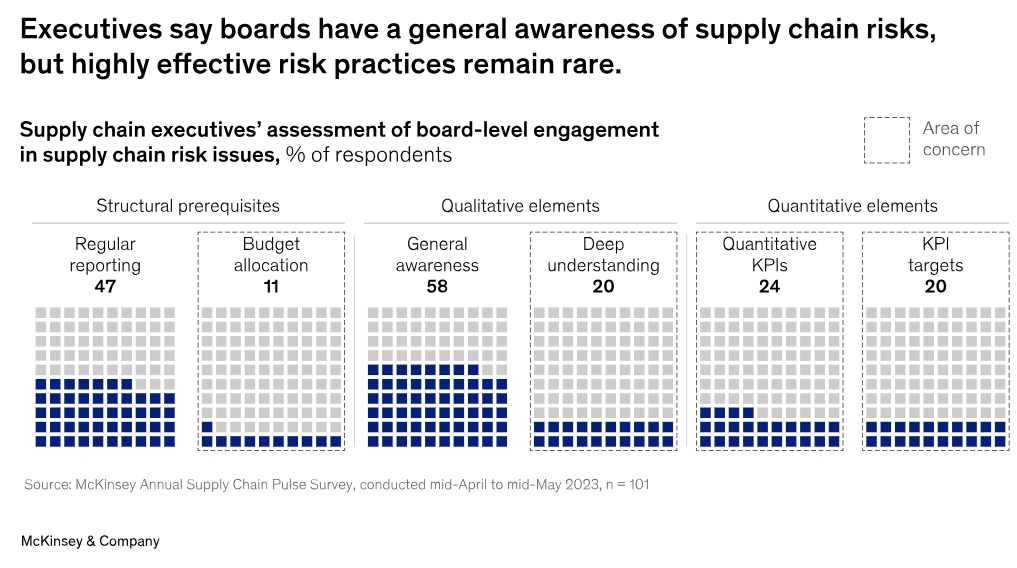

According to McKinsey, many companies lack centralized risk management teams, and responsibility is often fragmented across multiple departments. Furthermore, supply chain risk is not regularly reported at the board level, with fewer than half of respondents indicating board-level involvement and only one in ten companies have dedicated budgets for risk management. Additionally, only 20% of senior leaders deeply understand supply chain risks, highlighting a need for stronger board engagement and the use of quantitative KPIs to drive more effective risk mitigation strategies.

More supply chain leaders in the C-suite

Many S&P 500 CEOs ascend to the top of the corporate hierarchy after cutting their teeth through leadership roles in functional areas such as finance, strategy, and technology. But in recent years, a small but growing group of CEOs have made the jump to the top after holding high-level roles in supply chain management and planning.

Your supply chain can be your biggest competitive advantage

According to Steven Bowen from Forbes,

“The traditional approach to supply chain is to see it as a way to extract cost. This outlook is only partially useful; a better approach is to see the supply chain as a way to create value. The extraction point of view looks at the supply chain as a series of cost centers with the primary goal being cost savings alone, which is an incomplete view.”

How can then an executive step up? Here are a few practical guidelines:

- Fortify our financial arsenal

Flexibility is your body armor. CEOs must bolster financial reserves and slash working capital to cushion supply shocks. Strong balance sheets mean survival when the next crisis hits. If you’re not thinking about financial flexibility, you’re already in the red. - Invest in operational agility

Your operations need to bend, pivot, and sprint. CEOs must make flexibility non-negotiable—faster production shifts, simpler portfolios, and backup suppliers and invest in the right technology to improve. - Build a nimble, adaptive workforce

You can’t just tweak your org chart—your whole company needs to be able to move. CEOs should foster a culture of agility, where cross-trained teams can adapt on a dime. It’s not a nice-to-have, it’s a survival skill.

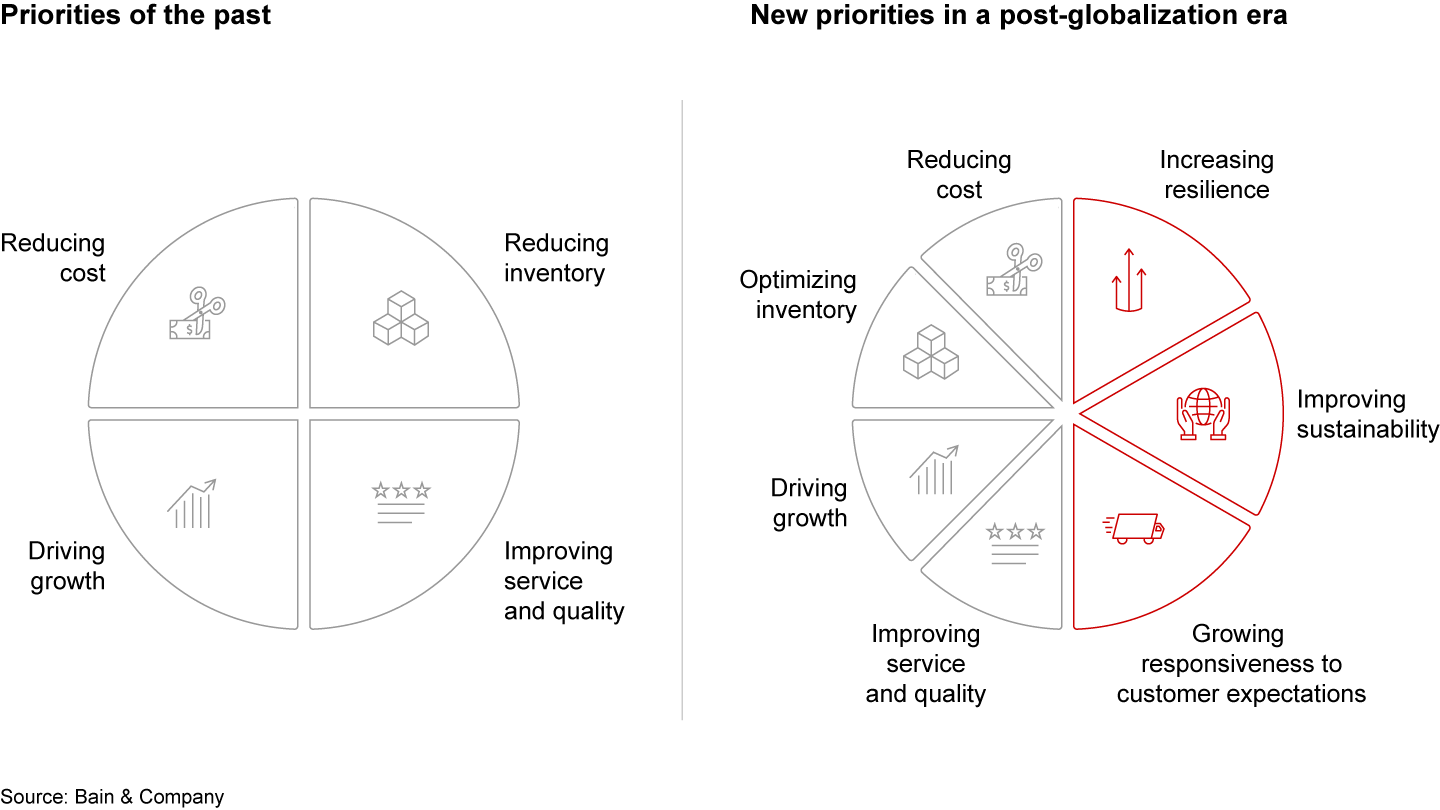

Supply chains of the future

The modern supply chain is undergoing a fundamental transformation, driven by the need for greater resilience, adaptability, and sustainability. As outlined in the text, successful supply chains of the future will be defined by several critical features that distinguish them from the traditional models of the past. These include built-in flexibility to withstand constant turbulence, a shift toward more balanced sourcing strategies like “split-shoring,” and enhanced visibility through advanced data and digital tools. Additionally, sustainability efforts are gaining momentum, with many companies adopting circular supply chains to reduce waste and resource extraction.

This signals that the traditional just-in-time, cost-efficient supply chains are no longer sufficient in an era marked by geopolitical instability, trade disruptions, and environmental concerns. Leaders must take a holistic view of their supply chains, recognizing that redesigning the entire system may be necessary to navigate the increasingly complex trade-offs. Collaboration across departments, such as procurement, R&D, and operations, is essential for finding end-to-end solutions, while cross-functional teams are needed to address specific challenges in manageable steps.

Moreover, the talent profile of operations teams must evolve, emphasizing strategic capabilities such as scenario modeling and network design. Companies are also forming deeper partnerships with suppliers and external stakeholders to address supply chain trade-offs more effectively.

Here is how DKSH raised the priority of supply chain resilience and partnered with AIMMS to leverage our leading supply chain network design software.

Conclusion

Reinventing the supply chain has become a make-or-break challenge for CEOs. It’s no longer about fine-tuning operations—it’s about bold, strategic decisions that can redefine an entire business. Companies that fail to adapt risk being left behind, while those that master the complexities of supply chain trade-offs will dominate the market, setting new benchmarks for operational excellence. For industry leaders, it’s a fight to maintain their dominance. For challengers, this is the moment to disrupt the status quo and leap ahead of the competition. The stakes have never been higher.

Ready to find out how to optimize your supply chain for resilience? Talk to our experts today!