Essential moves to shift from firefighting to optimizing short-term planning

Picture this: you are in charge of demand planning at a firm supplying essential base material to various markets, involving OEMs and CP companies. Your challenge is to balance the carefully established forecast with client demand. Since clients usually don’t adhere to the forecast, your task is to address the gap that emerges between your plan and actual demand, and assign the ‘pain’ to either sales or supply. Armed with ‘rules of thumb’ (product demand with high margin prevails over lower margin) and ‘guidelines’ (segment A clients have priority) you pass your judgment. Day after day, you experience that reality requires many more trade-offs than your guidelines allow for. How often are your verdicts met with approval?

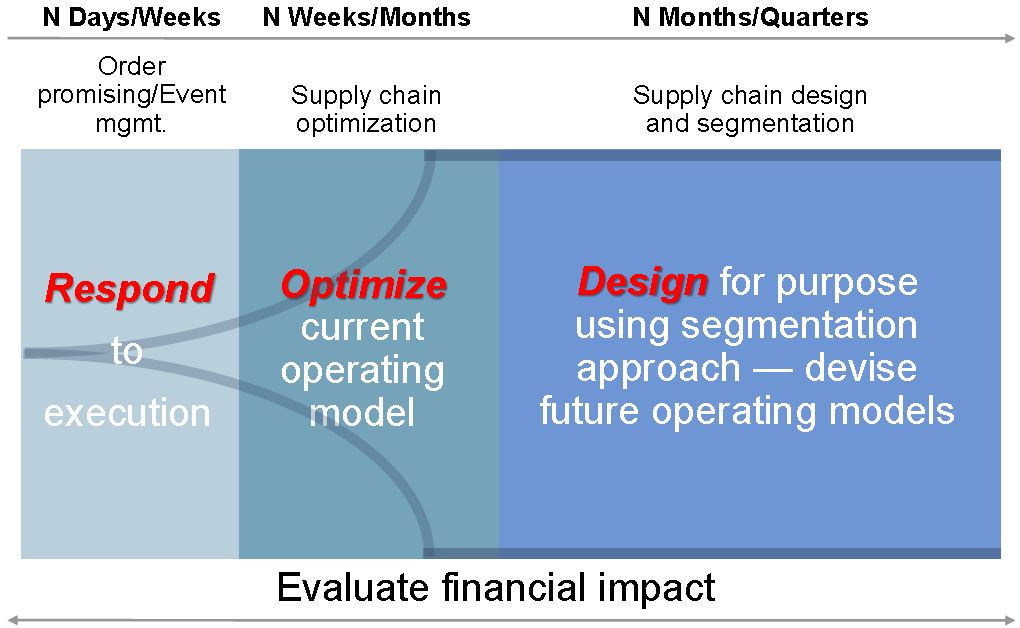

In “New Supply Chain Planning Model Highlights; Three Key Phases,” Gartner distinguishes 3 layers of planning, as shown in the graphic below. According to this graphic, optimization only takes place on the mid-term planning horizon. But I know from previous conversations with the author that this is not what Gartner actually means. The fact is that most companies spend significant effort working to ‘optimize’ their mid term horizon plan. Unfortunately though, they often adopt a fire fighting method for their short term fulfilment, distribution and production re-planning.

Dissecting a real world example

Let’s look at a typical example from a company we recently spoke with. This company actually does many things right in their mid-term planning; for them mid-term is 3-12 months. Ideally, this would be 24 months and rolling, but still, they are pretty advanced in mid-term business planning

– They distinguish between different types of clients:

- Large vs small

- Profitable vs providing base volume

- Past reliability of client volume forecast

- Quality of relationship with each client

- Mix of products that clients order

- Cost-to-Serve

– They distinguish between different levels of profitability for products and product families

- Demand pattern

- Seasonality

- Produce to order vs produce to stock

- Reliability of forecast per product(group)

- Complexity of production process

- Cost of Goods Sold

– They take product introductions and product life cycles into account

– They consider the financial implications of all their decisions in the overall plan

The company is reaching out to its main clients to get more visibility into upcoming demand, in order to further improve service and reduce inventory at the same time. On a side note, one thing that struck me is that the Consumer Product companies that they are supplying to are not providing enough visibility into their end of the supply chain. Whether they are not able to, or not willing, is still unclear for me. But what is interesting, is that these are the very same types of companies that have been complaining for decades about the retailers they deliver to, who are often reluctant to open up their end of the supply chain.

Now, this company I’m talking about, who has on average impressive figures for forecast accuracy, is struggling at the level of operational execution. Again, this is just an example of a trend we are seeing. The challenge that they experience on an almost daily level is this:

Client A forecasted to order quantity 100 of grade X; but he is now ordering 120 for next week. What can we do? Their systems allow them to adapt the production schedule, to produce more of grade X and shift other grades backwards in time.They can even assess whether grade X is more or less profitable than grade Y, that needs to shift backwards in production. However, they have no insight into the impact of that shift on:

- The Cost of Goods Sold

- The ability to fulfil other client orders

- Inventory levels

- Their ability to respond to other clients’ requests for change

- Profitability

Consequently, they struggle daily with events such as:

- A highly reliable and sufficiently profitable client is receiving his shipment too late, because of shifts in execution initiated for other clients

- Additional production costs are incurred for a client with only mediocre profitability or forecast accuracy, just because he orders a ‘high profit grade’

- Easy options to shift volume in time or for different clients are overlooked, because accurate stock visibility at the clients’ side is missing or not taken into account.

Solving the fulfillment dilemma

At this point, you will probably suggest visibility into the entire end-to-end supply chain as the solution. My argument is that visibility alone is not enough. You also need:

- Insight into all the changes that have occurred in the original plan

- Insight into all changes that might occur, including their likelihood

- Insight into the ‘best fit’ responses to these changes

- Insight into all the consequences of each of these ‘best fit’ responses

The more aspects and considerations are taken into account in the response-design process, the better your performance will be. If you start by listing all the aspects, considerations and restrictions of your daily planning process, we can help you develop a tailor made simulation and optimization workbench. That workbench will empower your planners to make complex trade-offs, explore the impact of setting different priorities, and make educated decisions based on a variety of insights.

Happy fulfilling!

Get a roundup of our best supply chain content every month in your inbox! Sign up for our blog digest here.