Inventory optimization was a challenge throughout 2020. Retail was among the industries where inventories suffered most. Other industries, like manufacturing, struggled to fill their inventory due to part shortages, port congestion and supplier shutdowns. What are supply chain professionals doing to build resilience in this area? How satisfied are they with their approach to inventory optimization and what are their top priorities? Read on to get the top 5 insights from our recent survey.

34% of companies are still doing inventory optimization ad-hoc

Over 100 professionals took our survey. Respondents work in a variety of industries: retail, manufacturing, chemicals, consumer packaged goods, metals & minerals, electronics, medical devices, and consulting among others. The majority hold director-level and managerial positions in supply chain.

While 55% stated that they have an inventory optimization process in place, a considerable 34% have no structured approach to inventory optimization and do it ad-hoc. Without a structured approach to inventory optimization, organizations take a reactive stance. This makes it very difficult to respond to rapidly changing conditions, like the ones most companies experienced last year. The good news is that organizations are eager to improve.

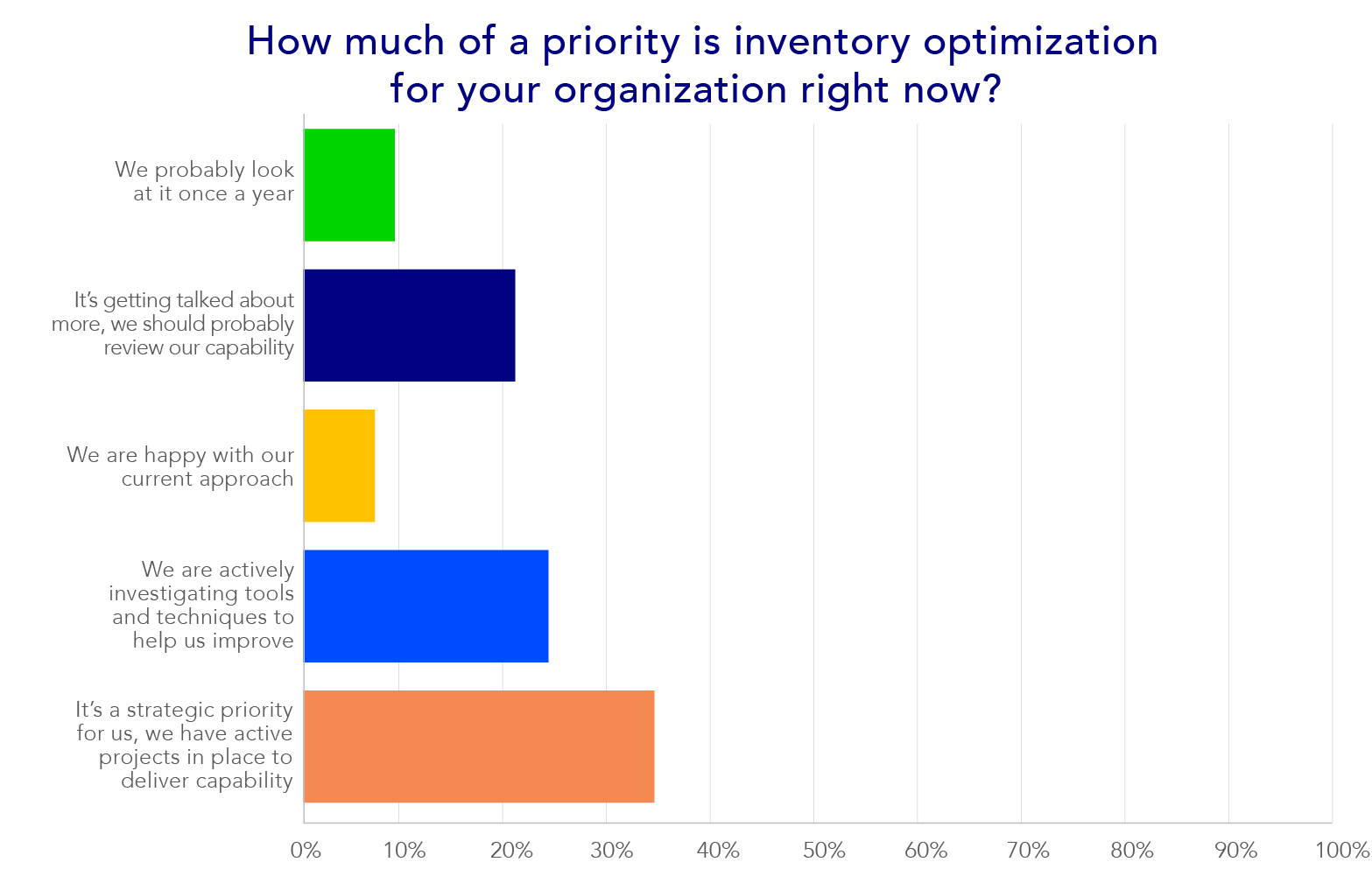

Inventory optimization is a strategic priority for a third of organizations

We asked our respondents if inventory optimization was a strategic priority at present. 35% confirmed this and said they have projects in place to deliver capabilities. 23% of respondents said that inventory optimization is getting talked about more in their organizations and might review this capability. Less than 10% are happy with their current approach. This echoes their perceptions of process effectiveness.

Only 7% consider their inventory approach very effective

A little over 40% considers their approach to inventory optimization “somewhat effective.” Only 7% would say it’s “very effective.” 29% said they consider it “not very effective” and 3% said it was “not at all effective.” When we drilled down into specific objectives, most respondents would rate their effectiveness in a neutral or unsatisfactory way.

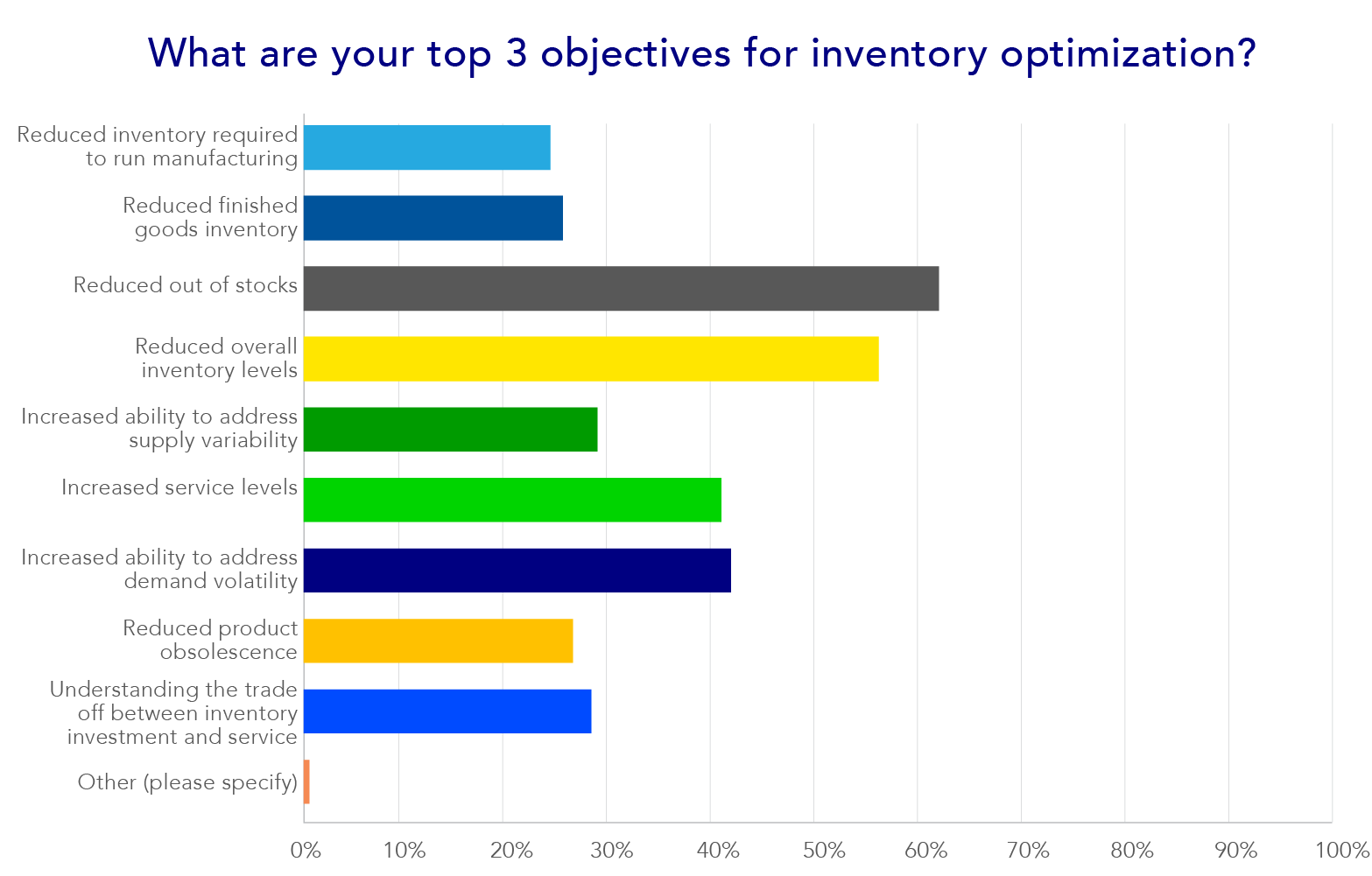

Lowering stock outs, reducing inventory levels, and addressing demand volatility are the top objectives

We asked respondents to choose up to 3 objectives they are looking to achieve with inventory optimization. Reducing stock outs stands out as the most pressing one; chosen by 62% of respondents. 56% said they are looking to reduce overall inventory levels, perhaps due to pressures on costs. 44% want to increase their ability to address demand volatility. Nearly 43% are looking to improve service levels as well.

When asked about their effectiveness in achieving these objectives, only 5% said they were “very effective.” 43% said they were “somewhat effective.” A combined 52% would rate their effectiveness in a neutral or unsatisfactory way.

On the surface, inventory calculations seem reasonably straightforward. Yet, they do require lots of data to be effective. So, we were curious to hear about the tools supply chain professionals are using. Spreadsheets are the most used technology for inventory optimization; 36% of respondents are using them. Perhaps unsurprisingly, many view this as a key challenge in itself.

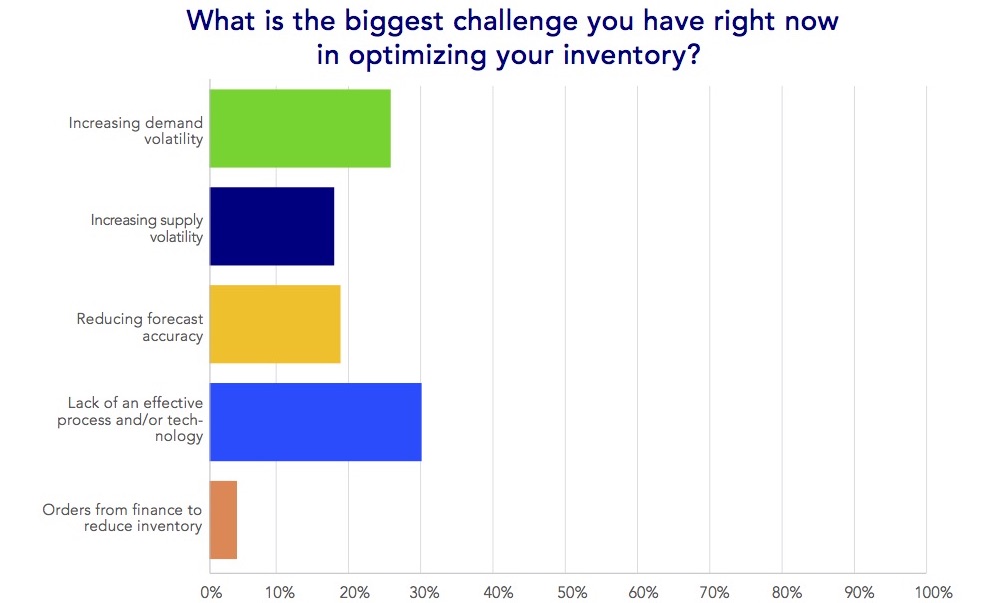

Lack of an effective process or technology is the greatest challenge

We asked respondents about the biggest challenge they face in inventory optimization. For 30%, it’s the “lack of an effective process or technology.” As we mention above, the majority use spreadsheets, which are error-prone and difficult to collaborate on. Some companies are dependent on the knowledge of a single employee to run the spreadsheet, which is highly risky for inventory health and puts a lot of stress on the team. Besides process and technology, external factors like “Increasing demand volatility” are also a top challenge. Forecast accuracy and supply volatility are also challenging for 19% and 18% of respondents respectively.

Inventory: asset or liability?

It’s a debate as old as supply chains themselves. Unless you are fortunate enough to have customer lead times that are longer than supply lead times or can predict with 100% accuracy when and what your customers will want, then the right amount of inventory is definitely an asset. It allows you to buffer for variability and meet your service level promises. But stock too much unnecessarily, and it quickly becomes a liability for your finance team. Stock too little, and you’ll have a service level issue.

35% of organizations consider inventory optimization a strategic priority and have projects in place to deliver capabilities – Tweet this

Inventory is a consequence of our business choices and the parameters that define our supply chains. This is why at AIMMS, we see Inventory Planning as closely related to Network Design. Our new application, AIMMS Inventory Planning, is the ideal companion for AIMMS Network Design. The app provides a visualization of inventory health and uncovers where your exposed areas exist. Unlike using spreadsheets, the application allows you to easily change parameters and create new scenarios which can be easily compared. If you think you can benefit from this capability, contact us to learn more or watch an on-demand demo.

For more insights on inventory optimization, download a complimentary copy of our report.