Tackling EU Manufacturing Industry Challenges: Lessons from Draghi’s Report

In September 2024, Mario Draghi published a report to the European Commission, it described an urgent and sobering outlook for Europe’s competitive landscape. The report opens by highlighting some existential threats to the EU economy, including productivity stagnation, workforce challenges, and missed opportunities in emerging technologies.

For supply chain leaders operating in the EU, particularly in energy-intensive industries (EIIs), these threats likely demand a proactive, strategic approach.

The EU’s diminishing competitiveness: What is the key factor at play?

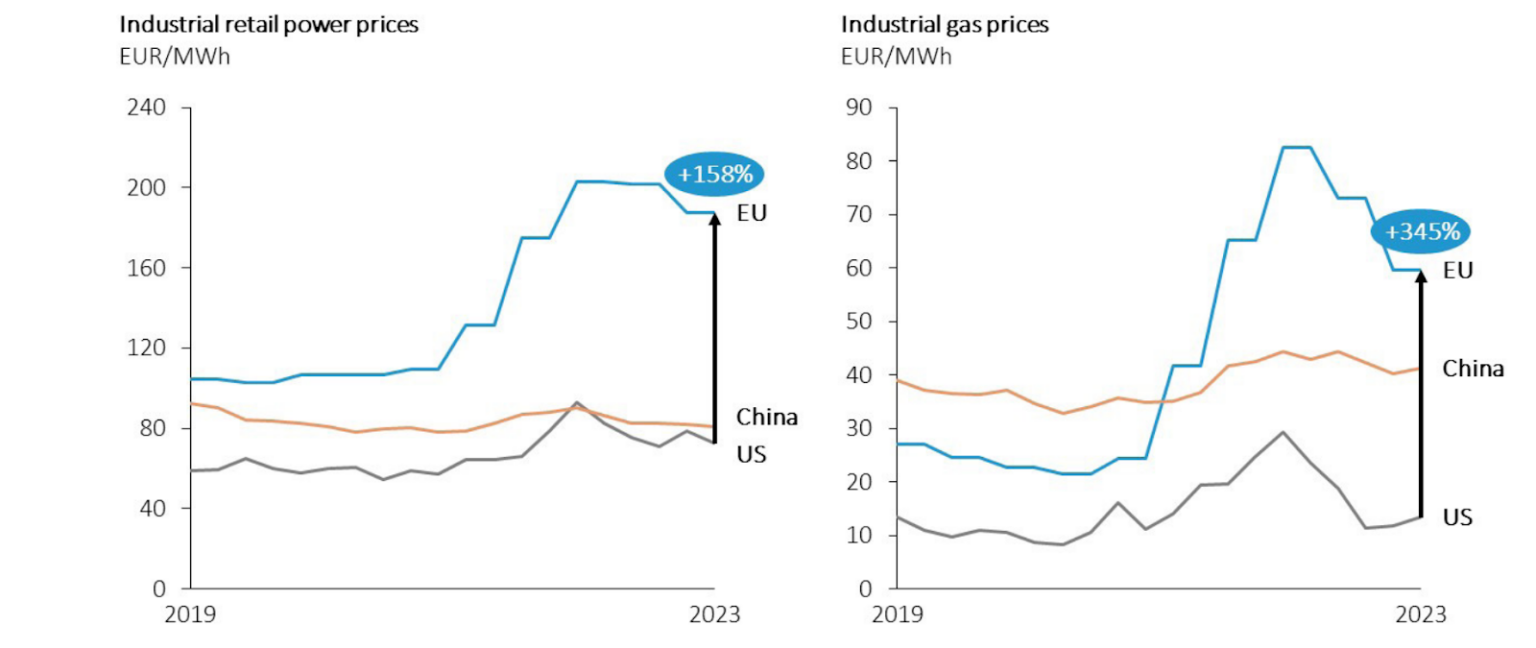

Draghi states that rising energy prices are a core challenge for industrial competitiveness. This issue is particularly prevalent in EIIs, which are fundamentally important for the EU’s self-sufficiency. The charts below show how the cost of both power (left) and gas (right) for EU companies – indicated by the blue lines – are far higher than in China and the US, indicated by the yellow and grey lines, respectively.

The challenge posed by high energy prices presents a potential opportunity. Draghi states that “competitive decarbonization” could aid EU competitiveness.

Avenues of Future Competitiveness

Europe has positioned itself as a leader in clean technology, responsible for over one-fifth of global clean innovations. With a firm foundation in clean technology, the EU could work on:

(1) reducing energy consumption by becoming more efficient;

(2) transitioning further to renewable energy sources;

(3) electrifying suitable industrial processes.

Setting ambitious climate targets could bolster innovation and drive new economic opportunities.

The Draghi report positions reindustrialization as a strategic pathway for EU economic renewal, targeting investments in clean technologies, digital transformation, and critical sectors like semiconductors, defense, and space. Draghi also advocates for a nuanced approach to supply chain positioning, balancing strategic autonomy with sustainable growth, rather than calling for changes such as supplier onshoring.

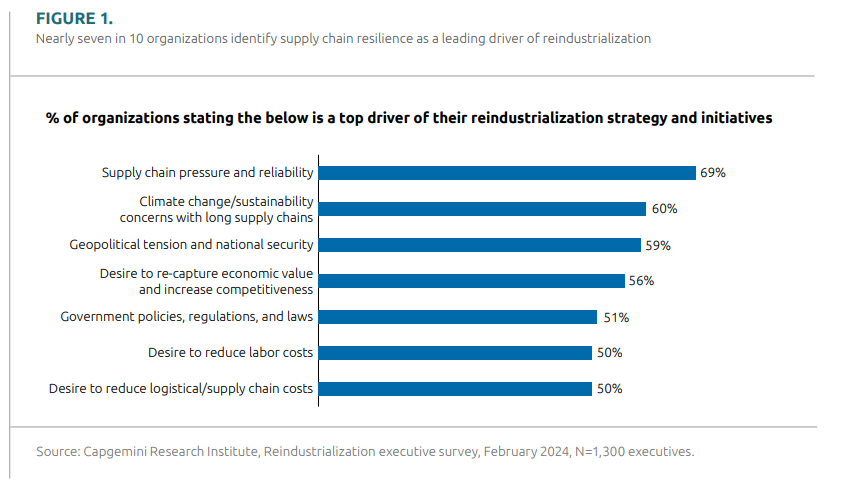

According to a recent Capgemini report, supply chain pressure and reliability is the top driver of reindustrialization initiatives.

Actions to Break the Low-Growth Cycle

Draghi identifies a cycle of “low industrial dynamism, low innovation, low investment, and low productivity growth” across the EU. To address this, there are some key actions that can be taken:

- Boost investment: Increase EU investment by roughly €800 billion per year to stimulate economic growth.

- Innovate: Revise financial regulations to unlock private capital for technology investments.

- Develop an industrial policy: Implement a strategy that aligns industrial, competition, and trade policies that enhance the EU’s competitiveness.

- Reduce energy prices: Introduce measures to lower energy costs for consumers and businesses, making European industry more competitive on the global stage.

- Accelerate digital transformation: Promote the adoption of digital technologies to drive productivity.

How can EII supply chain leaders help drive future EU competitiveness?

Business leaders could have a part to play in the future of EU competitiveness, as these supply chains demonstrate:

- Strategic importance – these supply chains are often central to critical value chains that contribute significantly to the EU’s GDP.

- Decarbonization potential – EIIs are often major emitters and may have significant potential for decarbonization.

Building on their critical role in the EU’s competitive landscape, EII supply chain leaders have the opportunity to potentially drive advancements in two key areas. First, by prioritizing energy efficiency, they can optimize energy use and reduce costs, directly enhancing the competitiveness of European industries. Strategic measures to manage energy consumption not only bolster the bottom line but also align with the EU’s sustainability objectives. Second, a focus on supply chain resilience. EII leaders may consider re-evaluating their supply chain footprint to mitigate some risks associated with external dependencies. This could strengthen their industry’s ability to respond to market and geopolitical shifts.

Strategic supply chain initiatives for a competitive EU

Draghi observes that the EU needs to act decisively if competitiveness is to be sharpened. For business leaders, a series of supply chain improvements may be considered. Some potential improvements include:

- Redesigning supply chains to prioritize clean technology integration and energy efficiency.

- Diversifying supply chains and reducing dependencies on non-EU sources.

- Optimize facility locations to balance cost, sustainability, and strategic autonomy considerations.

- Make trade-offs between cost and resilience, which could mean reducing margins in order to maintain reliability.

Reflecting on the Draghi report’s insights, the EU’s path to competitiveness likely relies on its ability to adapt and innovate, where supply chains could play an important role. AIMMS’ SC Navigator aligns with these objectives, offering support in decarbonization initiatives, which are vital for the EU’s competitive edge in clean technology. Additionally, its capabilities in navigating complex regulatory landscapes, like the CSRD or CBAM, and its provision for resilience and risk management could help in answering the report’s call for more robust, diversified supply chains.

Conclusion: Seizing the Opportunity

In today’s challenging EU environment, supply chain leaders are confronted with obstacles that may also present unique prospects for growth. Industry front-runners such as BASF, AkzoNobel, and Air Liquide are setting the pace, leveraging AIMMS technologies to refine and improve their operations. It’s more important than ever that EIIs continue to prioritize and expand on sustainability, aligning with evolving regulations, and improving process efficiencies. Supply chain leaders are poised to be part of the redefinition of the EU industrial landscape. As Draghi suggests, immediate, bold action is essential to capitalize on these opportunities.

Ready to find out how to optimize your supply chain for resilience? Talk to our experts today!