Gartner Research: 3 Trends Shaping Future Supply Chains

Gartner analyst reports are getting better. They’ve always been high quality but lately, their research and opinions really get me thinking. We are offering a complimentary copy of “Future of Supply Chain: Crisis Shapes the Profession” for a limited amount of time. I hope you enjoy this report as much as I have. It outlines key trends defining supply chains post COVID-19. I’ll discuss them briefly in this blog post.

Agility and resilience

Gartner points out that the importance of supply chain resilience and agility has become clearer given the major changes throughout 2020. They see companies that embrace resilience as being the ones that will better mitigate pain in the downturns and adapt to opportunities in an upturn. I would, however, first want to fully understand the cost of resilience before I took the plunge. For some businesses the costs will be negligible, for others, they will be significant. A higher cost base is also risky. Using scenario modeling over a digital representation of your supply chain is already a proven method to understand the trade-offs between costs and resilience, and we see our clients increasing their activity here.

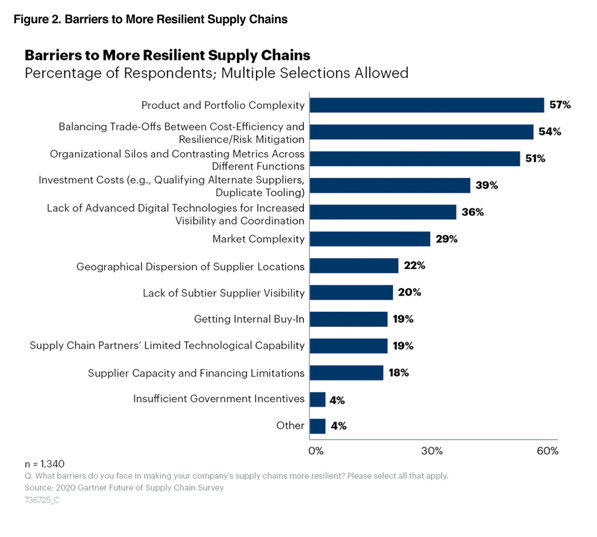

When asked “What barriers do you face in making your company’s supply chains more resilient?” 57% selected “Portfolio and Product Complexity.” I really like Gartner’s idea of applying resilience to only a subset of products within a portfolio, recognizing that some products remain stable throughout change and can remain low cost. They mention a potential trend to reduce the number of SKUs, which would be very beneficial in reducing complexity and waste.

Supply chain segmentation is also on the rise again. In the report, “most organizations say that they are investing now, or plan to invest, in supply chain segmentation as a way to target their strategies appropriately for different products, customer segments and channels to market.”

It makes sense that the quest to remove costs and improve service will translate into improving service for tier one customers and reducing costs to service others. I live with my family in a remote area and for example, Amazon Prime deliveries have extended out from 1-2 days to 5-6 days. Amazon can deliver in heavily populated areas the next day for a fraction of the cost. So, obviously I’m a tier 2 or 3 customer and I’m OK with that. It’s better than creating a lot of logistics waste and the next day delivery service is mostly a supply chain tool to increase sales – it’s usually not needed.

The other trend I find compelling is the rise of purpose-driven organizations.

Purpose-driven supply chains

Gartner’s research on purpose-driven supply chains is a good start to a great conversation. Last year, we started working on an initiative at AIMMS which would embed purpose-driven goals into strategic models and run scenarios to capture the costs of the various trade-offs. The technology already exists to run these models, but technology isn’t what’s holding us back. What holds us back is the difficult question of what we want to be and what type of impact we wish to bring. These are very significant questions to answer. We’d love to work with one of our clients to create a model that can incorporate both commercial interests and wider considerations to see where it takes us.

Hyperautomation could be one of our big tests in supply chain and has the potential to have a considerable impact on purpose-driven supply chains. Reducing headcount through automation and offshoring have brought great benefits in terms of access to cheap products and corporate margins, but Gartner notes the changes in attitude and the reshoring of production. It’s unlikely in this time of social trauma that replacing a large number of supply chain execution employment with technology will pass unnoticed.

It could just be that while there will be a reduction in total planning hours, as more of the heavy lifting will be automated, we have an opportunity to change working conditions for supply chain planners. For example, reduced work hours so that the decisions they make, are made with fresh minds and with more space for continued learning. Hyperautomation, in this sense, would help to augment instead of replace human activity.

Speaking of hyperautomation, there are other technology investments Gartner expects supply chain executives to make in the coming two years. When asked “What technology adjustments is your company making, or planning to make, to achieve greater resilience or agility?” 66% stated they are investing in “Supply Chain Visibility and Mapping” and 58% are investing in “Enhanced Planning.”

66% [of supply chain execs] stated they are investing in “Supply Chain Visibility and Mapping,” and 58% are investing in “Enhanced Planning.” – Tweet this

So how will these technology investments shape future supply chains?

The Effects of Rising Digitalization

It seems that Gartner is predicting that we’re going to be able to use all of the knowledge we’ve created in supply chain and the incredible technology available to exert far more control on the supply chain. I’m personally not sure that a better control and command system is the real breakthrough. Instead, I’d like to see more on distributing supply chain decision making, all the way to giving customers a choice of how they wish to consume products according to the trade-off of commercial, social and environmental impacts. That’s a very different model that puts optimization and scenario understanding in the hands of the many.

I welcome you to download your complimentary copy.

Resources cited: Gartner, Supply Chain Executive Report: Future of Supply Chain — Crisis Shapes the Profession, Supply Chain Community Contributors, 30 December 2020.