Scaling Through Mergers & Acquisitions: Supply Chain Optimization Best Practices

Mergers and acquisitions (M&A) are powerful strategic tools for growth, but their success hinges on the seamless integration of supply chains. Poorly executed supply chain mergers often erode expected synergies, inflate operational costs, and disrupt customer service.

Given the significant role supply chains play in cost efficiency and operational effectiveness, companies must approach M&A with a structured, data-driven strategy to ensure post-merger supply chain optimization, minimize risks, and unlock long-term competitive advantages.

What do the numbers say?

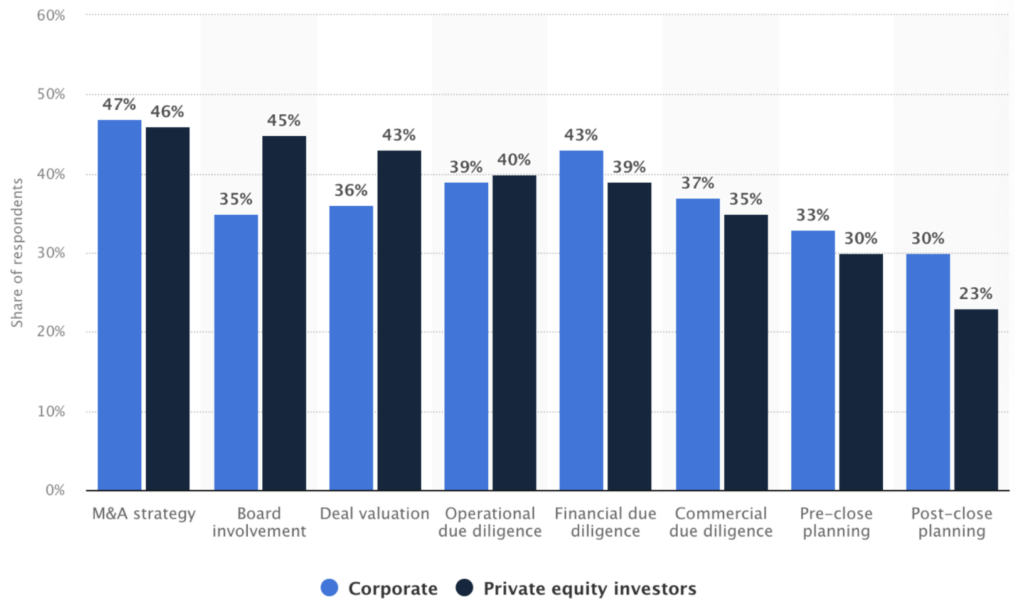

According to a survey conducted by Statista in 2021, most respondents indicate that a clear M&A strategy is the most important factor for achieving a successful M&A.

However, studies indicate that between 70% and 90% of mergers and acquisitions fail to achieve their anticipated objectives. This high failure rate is often attributed to factors such as overvaluation, cultural mismatches, and inadequate integration planning.

Here are the main areas where failed projects happen:

- Supply Chain Synergies in M&A: In the consumer and industrial products sectors, supply chain synergies can account for more than half of the total synergies realized in M&A transactions. These synergies often stem from areas like manufacturing optimization, distribution efficiencies, and procurement enhancements (source).

- Impact of Poor Due Diligence: Research indicates that more than 60% of executives identify poor due diligence as a primary reason for M&A deal failures. Inadequate due diligence can lead to unforeseen challenges, including supply chain disruptions and missed synergy opportunities (source).

- Supply Chain Delays and Revenue Impact: A study found that nearly 60% of small and mid-sized businesses reported losing up to 15% or more in revenue due to supply chain delays. This underscores the critical importance of efficient supply chain management in maintaining financial performance (source).

Strategic Phases of Supply Chain Integration in M&A

1. Pre-Merger Supply Chain Due Diligence

Effective supply chain integration starts well before an M&A deal is finalized. Conducting a deep-dive analysis of both companies’ supply chains helps identify risks, synergies, and operational gaps that could impact the post-merger structure. This involves mapping the entire network from suppliers and warehouses to transportation routes and distribution centers to assess potential overlaps and inefficiencies.

It is also critical to evaluate the technological infrastructure of both companies, as mismatches in enterprise resource planning (ERP), warehouse management systems (WMS), and transportation management systems (TMS) can lead to costly and time-consuming integration challenges.

Furthermore, regulatory and compliance issues must be considered. If the acquired company operates in different jurisdictions, supply chain leaders must ensure adherence to local regulations, tariffs, and trade agreements to avoid disruptions post-merger. Companies that fail to assess supplier contracts and regulatory risks often face unexpected delays and penalties that can erode expected synergies.

2. Post-Merger Supply Chain Integration and Optimization

Once the deal is completed, the real challenge begins integrating two separate supply chains into a single, cohesive network that maximizes efficiency and cost savings. Network optimization is a critical step in this phase, requiring a strategic analysis of the combined entity’s warehouse and manufacturing footprint to determine where consolidations, closures, or expansions are needed.

Companies should leverage supply chain modeling tools to simulate various configurations and evaluate the trade-offs between cost and service levels.

One of the key areas of focus is supplier consolidation. Many M&A transactions result in overlapping supplier bases, and failing to streamline these relationships can lead to inefficiencies and missed cost-saving opportunities. By rationalizing the supplier network, companies can leverage increased purchasing power to negotiate better pricing and terms. This approach has been successfully applied by companies like Dell and EMC, whose M&A-driven procurement consolidation resulted in $1.7 billion in annual savings and a 30% reduction in lead times.

See how AIMMS helps a chemical manufacturer optimize its supply chain network after a merger.

3. Strategic Network Design for Long-Term Efficiency

After initial integration, companies must focus on designing a long-term supply chain strategy that enhances resilience and scalability. Network modeling and predictive analytics play a crucial role in this phase, allowing companies to simulate different supply chain scenarios and proactively address risks before they escalate.

Risk mitigation is another essential component. Companies should diversify their supplier base to prevent over-reliance on a single vendor, which can become a critical vulnerability in times of disruption. Building a resilient supply chain also involves creating redundancies in key areas, such as maintaining dual-sourcing strategies for critical components. This approach is particularly relevant in industries like electronics and automotive, where supply shortages have caused massive disruptions in recent years.

Sustainability is also emerging as a critical factor in M&A supply chain decisions. Companies are increasingly prioritizing ESG considerations, optimizing routes to reduce carbon footprints, and integrating circular supply chain principles to minimize waste. As sustainability regulations tighten globally, businesses that fail to align their supply chains with ESG goals risk reputational damage and financial penalties.

Recommendations for Supply Chain Leaders

To ensure a successful M&A supply chain integration, supply chain leaders should:

- Engage in early due diligence to uncover hidden risks and identify synergy opportunities.

- Leverage advanced analytics to optimize network design and assess cost-service trade-offs.

- Establish a cross-functional integration team to ensure alignment across procurement, logistics, and IT.

- Develop a supplier consolidation strategy that enhances bargaining power while maintaining resilience.

Conclusion: Supply Chain as a Competitive Advantage in M&A

The success of an M&A transaction is not just about financials—it hinges on how well the newly formed entity can integrate and optimize its supply chain. Companies that treat supply chain strategy as a core pillar of M&A planning gain a significant competitive advantage, reducing costs, enhancing service levels, and accelerating synergy realization.

By embedding supply chain intelligence into the M&A process, organizations can avoid common pitfalls, mitigate risks, and unlock long-term value. In today’s complex and volatile global business landscape, an optimized and resilient supply chain is not just an operational necessity, it is a strategic differentiator that determines the true success of a merger or acquisition.

Ready to find out how to optimize your supply chain network? Talk to our experts today!