The chemical industry is facing some powerful changes that are directly impacting revenues and margins. It’s also highly competitive. Everyone is trying to dominate their niche. This means chemical companies need to be adept at managing costs and profitability. But doing this ad hoc is too difficult. Having the right technology is key.

The chemical industry is facing some powerful changes that are directly impacting revenues and margins. It’s also highly competitive. Everyone is trying to dominate their niche. This means chemical companies need to be adept at managing costs and profitability. But doing this ad hoc is too difficult. Having the right technology is key.

Spreadsheets and legacy tools are no longer enough for chemical companies

There’s a lot of flux in the chemical industry. Raw material prices fluctuate constantly. Selling prices vary depending on international markets and what’s happening in certain countries. That margin between selling prices and raw material prices needs to be carefully managed.

At the same time, the industry is consolidating and changing rapidly. As mergers and acquisitions increase, managing demand in large geographies becomes even more complex. Companies that spin off due to M&A activity need to find ways to manage their own destiny. Many chemical companies are using S&OP (Sales & Operations Planning) as a tool to tie up operational planning and activity with financial goals and strategy. Many are still using spreadsheets and legacy tools to support this process. These tools may provide a good starting point for S&OP, but do not always provide the sustainability or flexibility that companies require to be agile during times of rapid change.

Changes in demand, prices, margin, opportunities to sell intermediates as final products, and other changes can happen quite suddenly. Even the smartest people can’t calculate every possible option and suggest the best alternatives to improve margin in such fast-changing situations. This could mean generating and evaluating millions of different possible solutions and finding the best one. Talk about finding the needle in a haystack! What prescriptive analytics capabilities can bring, is the ability to throw all these variables and constraints into the mix and simply press the optimize button to uncover the opportunities.

The case for prescriptive analytics capabilities in S&OP

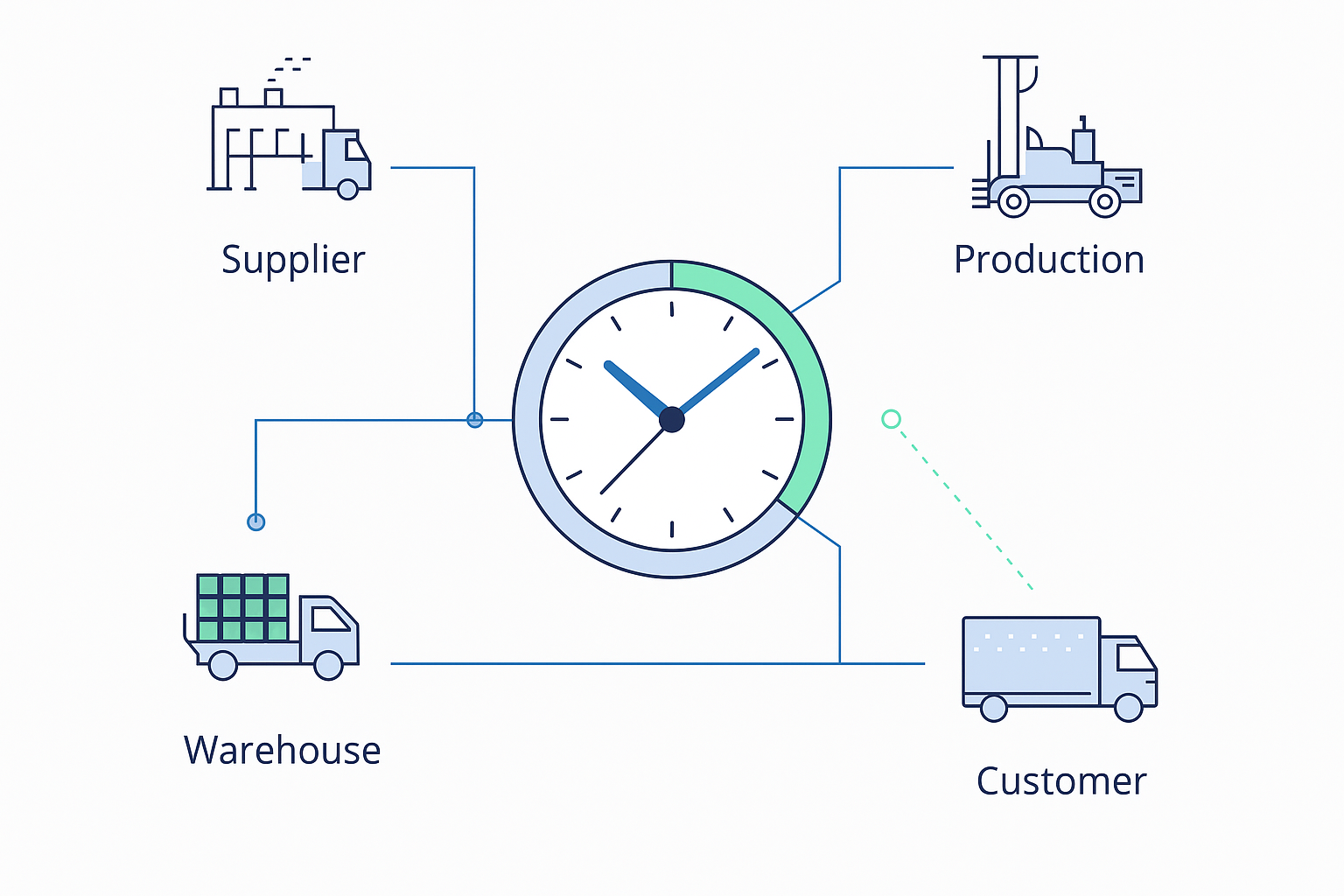

S&OP technology needs to support companies to visualize all the data they need to support the different phases in your S&OP process, and facilitate collaboration. But imagine if, in addition to this, you are able to foresee what may go wrong in the future, and get a prescriptive recommendation to optimally meet your financial objectives. With advanced analytics, you can predict what will go wrong and find strategies to mitigate the problems. The technology should recommend strategies for building capacity, optimizing product mix under constrained conditions, and using stock build or draw down to mitigate capacity shortages. Suddenly, your S&OP meetings become more productive. Your decisions become better, and can be taken quickly to ensure the best business result – even in an uncertain climate.

You may think that the software required to achieve this comes with a high price point and tedious implementation process, but that doesn’t have to be the case.

How AIMMS S&OP can help

A lot of the software out there is expensive to purchase and implement. AIMMS is challenging that paradigm. We’re on a mission to make software more affordable and accessible for business people. AIMMS S&OP is very different from existing S&OP solutions that only balance forecasts with capacity but don’t focus on optimizing margin contribution. AIMMS leverages 30 years of experience in optimization, and brings that to bear in the S&OP technology. We’ve made it easy to use and customizable to your unique business requirements. We believe strongly that companies should be self-enabled with technology, and not rely on expensive or complicated implementation efforts. We put the technology in the hands of business decision makers, you don’t need to be an IT or math expert to get the benefits.